2 min read

No Surprises Act aims to reduce unexpected medical and surgical bills

While it isn’t possible to prevent all of life’s surprises, Michiganders attempted to eliminate one in health care with its own version of the No...

2 min read

Action Benefits

:

May 30, 2025 11:42:47 AM

Action Benefits

:

May 30, 2025 11:42:47 AM

When a medical emergency strikes, the last thing you should be worried about is whether the hospital is in your insurance network. And thankfully, you don’t have to — at least at first.

Federal laws like the Affordable Care Act, the No Surprises Act, and EMTALA ensure that care for emergent, life-threatening conditions is always billed as in-network, even if the hospital or doctors you see don’t normally accept your insurance.

That’s the good news.

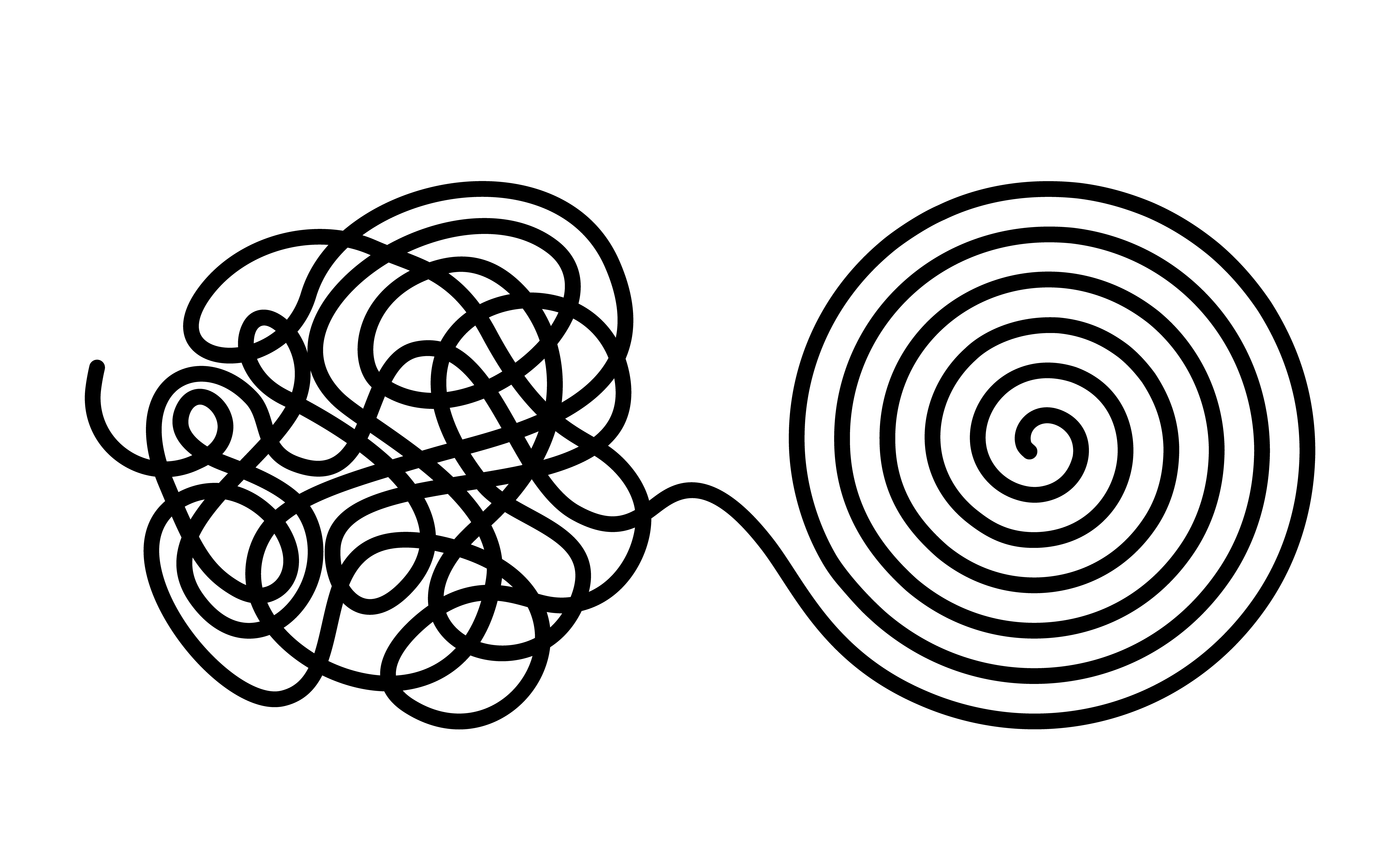

But there’s a second part to the story — and it’s where many patients unknowingly end up with out-of-network bills. Let’s break it down.

An “emergency medical condition” is defined as anything that a reasonable person would believe needs immediate attention to avoid serious harm. That includes:

Chest pain or signs of a heart attack

Difficulty breathing

Sudden loss of consciousness

Severe bleeding

Stroke symptoms

Serious injuries or trauma

In these situations, you should always go to the nearest emergency room. The law protects you during this critical window.

Here’s where things get tricky.

Once your condition is stabilized — meaning you’re no longer in immediate danger — the hospital may transition you to post-stabilization care. This could include:

Staying overnight or being admitted for observation

Getting additional scans or procedures

Seeing a specialist

Being transferred to another facility

At this stage, the law no longer requires that care be treated as in-network. And unless you’re careful, you could be on the hook for out-of-network charges without realizing it.

Hospitals may ask you to sign paperwork that includes notices and consents related to receiving out-of-network post-stabilization care, and there are some conditions about when they can do so:

Before signing a notice or consent form:

Ask: “Is this facility in my insurance network?”

Confirm whether any specialists you’ll see (like a surgeon, anesthesiologist, or radiologist) are also in-network.

If they’re not, ask if you can transfer to an in-network hospital or provider.

Don’t sign consent forms agreeing to out-of-network charges unless you fully understand what they mean.

This doesn’t mean you should delay necessary care, but it does mean that once you’re stable, it’s smart to pause and check.

Know your preferred hospitals. Check now which emergency rooms and facilities are in-network with your plan.

Call your insurance agent. We can help you verify network status or find a plan that includes the hospitals you trust.

Stay informed. Knowing how post-emergency care works helps you avoid unnecessary expenses later.

If you’re unsure whether your plan includes the hospitals or specialists you want, or if you’d like help reviewing your current coverage, we're here to help.

Contact us today to go over your options or find a plan that fits your needs.

Disclaimer: This blog post is for informational purposes only and does not constitute legal, financial, or medical advice. For specific guidance on coverage or billing, consult your insurance provider or a licensed professional.

2 min read

While it isn’t possible to prevent all of life’s surprises, Michiganders attempted to eliminate one in health care with its own version of the No...

Executive orders carry headlines. But, they don’t carry much legal weight. At their core, executive orders are simply a memo directing agencies...

For a variety of reasons, older Americans may choose to divorce. While there are several considerations that the now-ex-partners should be aware of,...